Here’s a fact of life: 100% of the whole is all we’ve ever got. That’s the total we can work with. All those insta-fitness coaches and motivational speakers who tell you to give 110% have the right idea about giving your all … but mathematically, it doesn’t add up. And we definitely can’t apply that logic to revenue (even if we’d love to!)

If you find a little more than your usual 100%, when it comes to finance you don’t have 110. You’ve just got a bigger 100%.

When it comes to your business, 100% is the number you’re always working with. That’s our old friend revenue. Some of you call it turnover, but doesn’t matter what label you’re putting on it…

Your Revenue = your 100%

Now, let’s think about cake.

Revenue cake, and how to serve it

Revenue is a whole cake, one of those nice big round ones with the jam in the middle. The bit left over once every part of your business has snatched up a slice is the bit you’re really interested in — that tasty, jammy morsel called profit.

Probably you know about the cake. We know this is not your first birthday party. But we’ve spent our lives studying this cake, and we have something very important to say about it.

If you’re a hospo business owner, you know that the things eating up your 100% cake are your labour, overheads and purchasing. That means adios to 80-95% … or sometimes more. Sometimes, the floppy little slice that’s left over can’t even stand up on its own on the plate.

But that little morsel has to pay your home mortgage, your kids’ school fees, your unexpectedly large water bill, your well-deserved holidays and the emergency dental work you wish you didn’t need. It has to support your inconvenient taste for expensive wine, and your sudden desire to take chi kung classes. It has to support your investments, and your retirement fund. It’s your income. And that’s a lot to feed with one sloppy sliver of cake.

Side note:

If you’re a business manager, you know that a booming business — and an owner who has enough leftover pie to satisfy their inconvenient taste for expensive wine — is good news. You’re under less pressure to find the scraps of the cake someone already ate, and you’re way more likely to hear “yes” to that pay rise we know you deserve. Profitable business works for everyone.

How to do it?

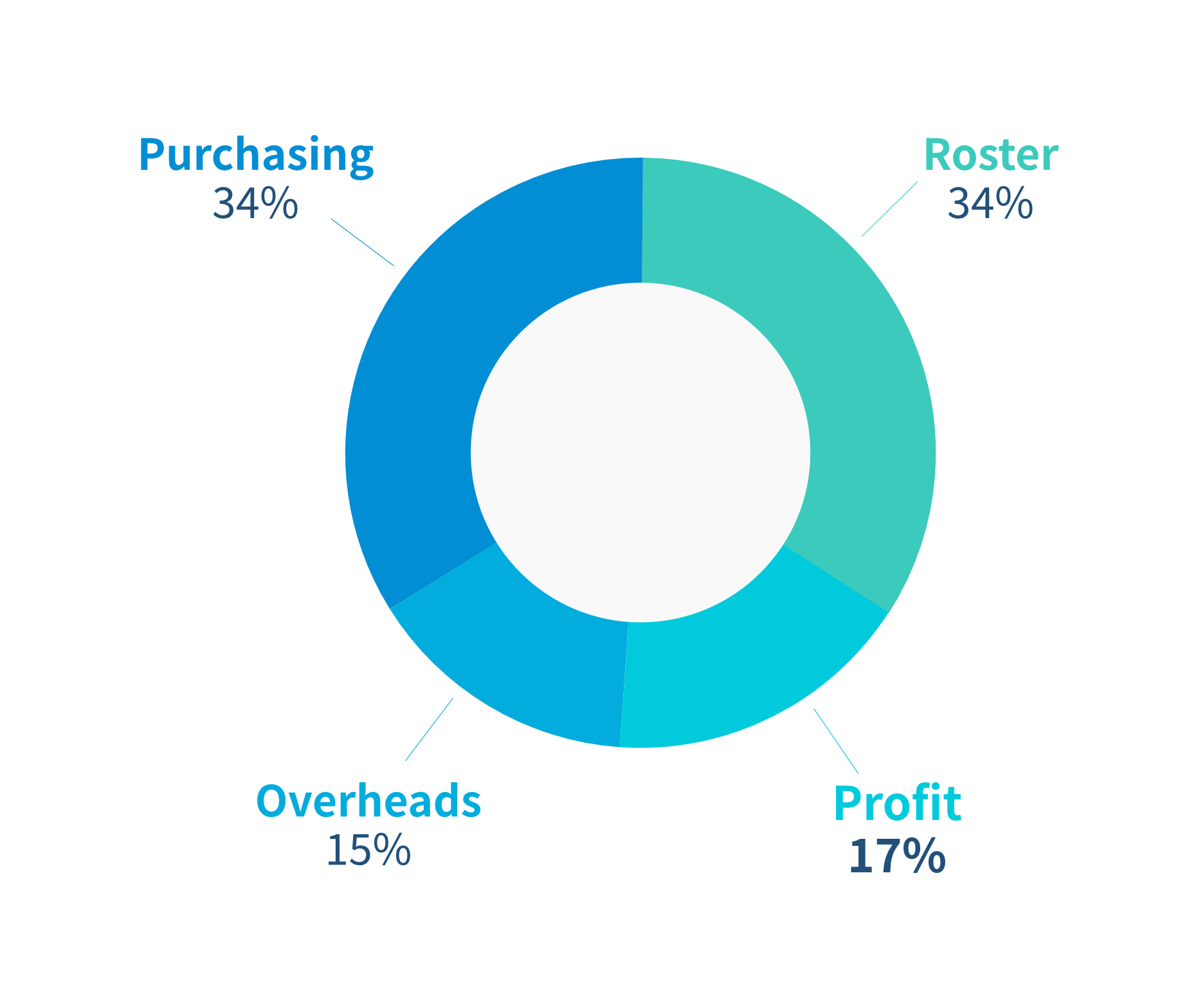

Imagine a pie chart where the whole circle = 100% = net revenue (revenue after GST & discounts).

Costs come out of that revenue like slices of pie. So maybe:

- Labour = 34%

- Ordering = 34%, so GP = 66%

- Overheads = 15%

At the end of the day, that leaves 17% profit. Not too shabby!

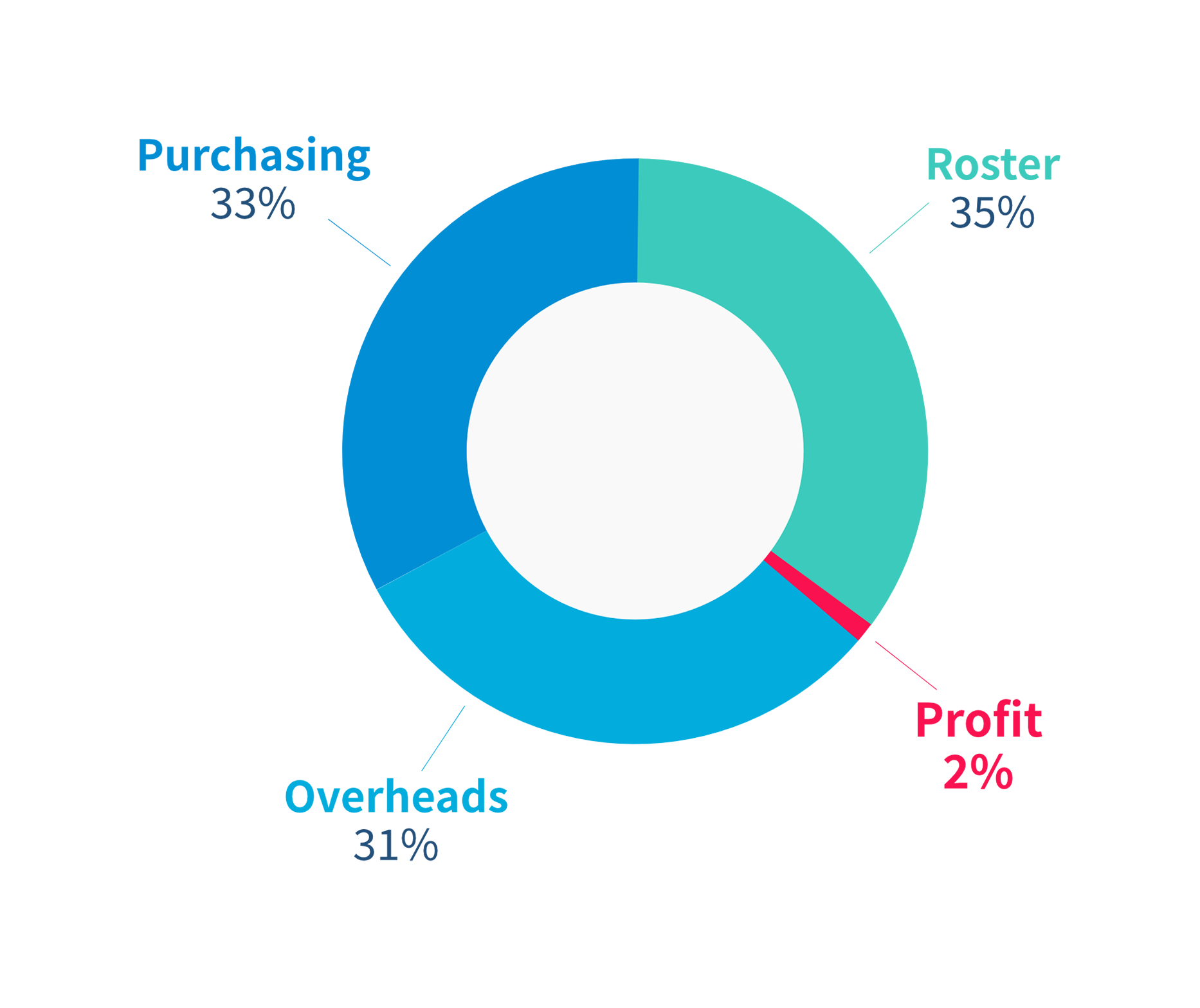

But if your labour costs blow out — lets say you have a few training shifts and a quiet morning that’s overstaffed — that 33% can quickly turn into 38%. And if the chefs misjudge how much stock to order and the barista goes overboard on the milk … your GP could drop to 64%. Now, you’re looking at that industry average profit mark, around 4%. Which, on a $25,000 turnover, sends you home with $1,000.

Which you’ll have the pleasure of paying income tax on.

And don’t forget to pay your own super.

Now an easy breezy employee pay check without the stress actually looks pretty damn good.

Basically, when everything’s dandy within your 100% revenue cake, everyone’s happy. And when you’re not in control of all the pieces, everything sucks.

You don’t usually need better revenue to improve profit

If you’re struggling to keep enough cake for yourself at the end of the week, you’ve got two options.

- Make the cake bigger. Trying to make a bigger cake by increasing revenue is one way to go about it. But we all know that’s not easy. And with a bigger cake comes greater costs to each slice — staff, purchasing and overhead costs start to climb. You can end up back in the same position. And we all know the famous addage: it’s not about size … it’s about how you use it.

- Cut the cake smarter. Right now, Australian hospitality businesses end up with about 4-6% of their cake once all the aspects of their business have hacked away at it. Labour, COGS, property and operations costs are all rising scarily fast, and businesses need to find a way to cope. So by being more careful about the way we cut each of these pieces, we can improve the state of the profit slice… without making the cake bigger.

In case you couldn’t tell, we’re fans of option 2. Make your business strong with the revenue you’ve got, and it will naturally grow.

Why don’t we love option 1? Because you can boost revenue, but still have ballooning costs. If you cut the cake badly, you end up barely seeing a difference in your profit even with huge revenue increases.

Rather than trying to bake bigger, we propose a sharper knife. Get smarter with your 100%, reduce the cost of doing business, and see more left over at the end of every week. Once each slice of your cake — overheads, staffing, rent, bills, etc etc — are portioned and cut perfectly, you’ll find your slice of profit looks bigger and tastier than ever before. But it’s a matter of understanding how each slice fits into the whole. Internal benchmarking.

Use benchmarking to control costs

What can affect the benchmarks you use to control costs in a cafe or restaurant?

Q: How can you use benchmarks in your business? A: However it works best for you!

Let’s look at a few cafe benchmarking scenarios. All of these are small cafes with $20K NET revenue this week.

- You’re a cafe with a focus on incredibly attentive service? Maybe your labour costs in FoH are higher than “industry standard”. But you have a simple menu with a good GP and a pretty good deal on the rent for your premises.

- This week’s NET revenue: $20K. Labour: 39%. Purchasing: 31%. Overheads: 20%. This week’s profit: $2,000.

- You’re a cafe making everything in house instead of ordering in? You’re keeping your purchasing benchmark super low, but spending more on staffing in the kitchen than another cafe might, while your chefs prep your amazing breads and pastries.

- This week’s revenue: $20K. Labour: 39%. Purchasing: 29%. Overheads: 22%. This week’s profit: $2,000.

- You’re a cafe at a shopping centre location with high rent? You also have high volumes of foot traffic, a quick-prep to-go menu and super fast counter service, meaning you’re keeping labour and purchasing costs nice and neat.

- This week’s revenue: $20K. Labour: 34%. Purchasing: 31%. Overheads: 25%. This week’s profit: $2,000.

As long as you’re careful about your costs, you can work within your revenue, overheads (fixed costs) and your business model to do great things. We’ve seen all these models work well and be profitable. It just depends what works for your team, your business and your bottom line.

Using real-time internal benchmarking means you can take power and carve your own fortune. Forget all the haphazard hacking. Use real numbers so you’re in control.

Using holistic restaurant management software makes you the master of your own cake.

And who doesn’t want to be a cake master?

So that’s our hot take. Improve your knife skills and make sure you’re really in control of your 100%, then focus on increasing revenue. Because if you increase revenue and keep the same benchmarks, there’s simply more money to go around.