Closed for the day? Surcharge on the bill? Or business as usual?

Many of us who get to enjoy public holidays relish the chance to have a leisurely meal out on a weekday. But how often do you get hit with that pesky 10 or 15% surcharge added to your bill? Or was your favourite place closed, even though you were sure they’d be super busy with holiday customers?

Both of these scenarios are annoying from a customer’s perspective, and reasonably so. But what’s happening behind the scenes?

The short version? Cafes, restaurants and bars are paying their people double to be there on a public holiday. So, unless they can roster half the usual team (and miraculously have them work twice as hard), the business is immediately on the back foot. But is it reasonable for them to pass that on to customers? Are we just giving the business owner a holiday bonus? Is it reasonable to close the venue instead? Data can reveal the truth of public holidays.

A speedy lesson in hospo industry profits

It’s important to start by taking a look at the industry.

Your local cafe, for example, sets up their venue (a capital investment, usually anywhere from $200-500K). Then, they’re able to make sales and bring in revenue. Once GST is taken out, their NET revenue needs to pay for the ingredients, the premises & amenities, all the operational costs, and the labour force. NET revenue can be called 100% of the cash they’ve got to work with, to pay for business, to make a profit and to justify their capital investment value.

- Gross Profit (the money left after buying in the ingredients to make food) is about 65-70%, so 30-35% is spent on ingredients.

- Labour typically costs 32-40% of a business’s revenue (including WorkCover, superannuation & casual loading/salaried leave, plus penalties)

- Rent & overheads typically fall anywhere between 10-20%

If we look at the higher end of these costs – 35% food + 40% labour + 20% overheads… then we’re at 5% left for profit. Doesn’t seem like much, does it? But that’s not unusual. In fact, it’s absolutely normal. The industry average profit margin is between 3-6% across restaurants, cafes and takeaway. We’re not trying to catastrophise things. This is the reality for many business owners. It’s also why Viability exists.

A busy metro/ suburban cafe typically looks something like this:

- Revenue average $25-30K per week.

- 5% profit margin, about $1,200-1,400 weekly (before tax).

- For an owner, it’s like being on a salary of $70-75K before tax… but no super paid and no annual leave or sick leave.

- And almost always working far more than the standard 38 hour week.

- And if they don’t make as much revenue one week, their profit goes right down along with revenue.

When it comes to a public holiday, a business running a 5% average margin may have a higher revenue and try to staff even more carefully because of the high rates. But when faced with doubled wages, their labour cost can still stretch to 60%, 70%, or in the worst cases 80%. Essentially, before they even buy in all their ingredients for the day they’re likely to be in the red.

Even spreading the burden out over a full week, the extra staffing cost takes the weekly labour percentage 13-20% higher than a normal week’s 40% (depending on if we’re looking at a 5,6 or 7 day opening site). And after overheads and orders, that takes their whole week’s profit margin straight into a loss.

The site, if they choose to open, will probably try to lessen the loss by asking for a 10-15% surcharge on purchases. Seem reasonable?

Because the reality is:

- They may make a loss if they close, because they aren’t taking as much revenue, so overheads like rent and bills must be paid from a smaller weekly revenue, meaning a higher percentage of total spending goes to overheads, and their narrow margin is gone. Losing revenue is never a good thing when you’re running 5% above the line. Unfortunately, they may also lose favour with customers if they close, who could try another local venue and potentially even be converted.

- They may make a loss if they open, because they’re paying out more than they’re bringing in, even before considering overhead cost for that day. They could lose favour with customers by applying a surcharge, or try to staff lightly because of the high wages and subsequently offer poor service compared to their usual standard – very risky for them.

What about high performers?

We’ve explained above what happens when the average cafe with a slim margin meets a public holiday. But the real problem is, even those who are well above the average in terms of profit margin aren’t profiting from a public holiday.

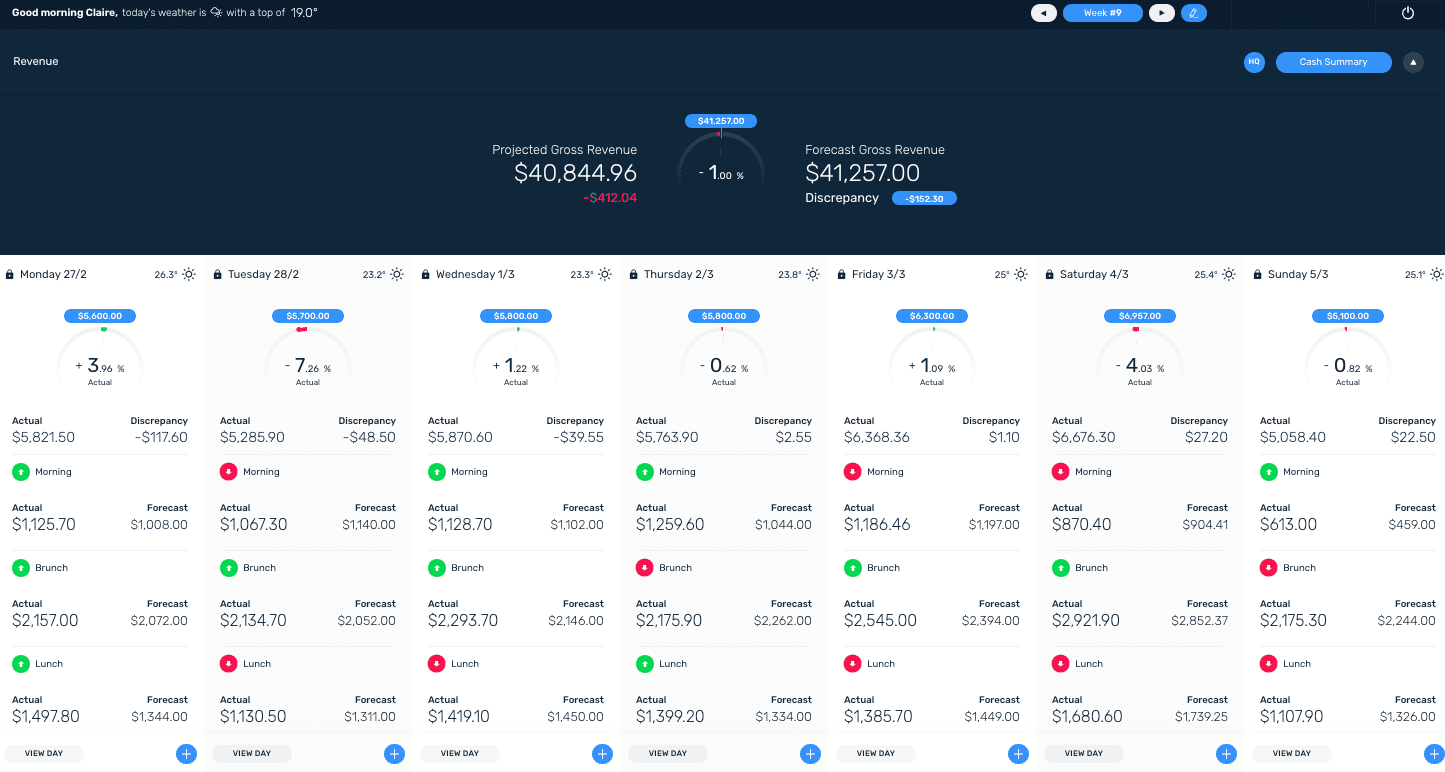

Let’s look at a real example of a high performing site in a random week vs a week with public holidays. We’ve got permission to share this anonymised data with you. Here’s a “normal” week for this espresso bar:

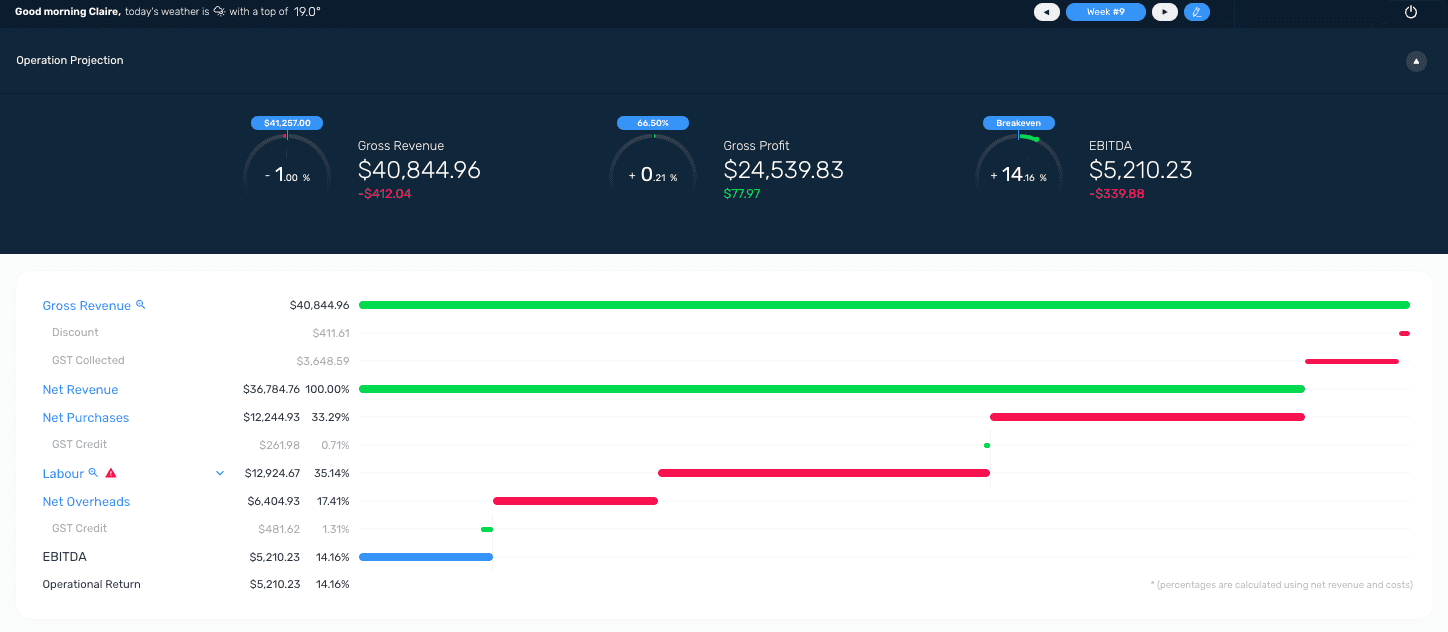

This cafe is fully managed (the owner doesn’t work on site, instead paying a manager to operate the cafe). They open 7 days in a regular week and return about 13-15% profit, around $5,000. They have high NET overheads at 17%+, as a franchise operating in a popular shopping centre.

They usually take around $40-42K gross revenue.

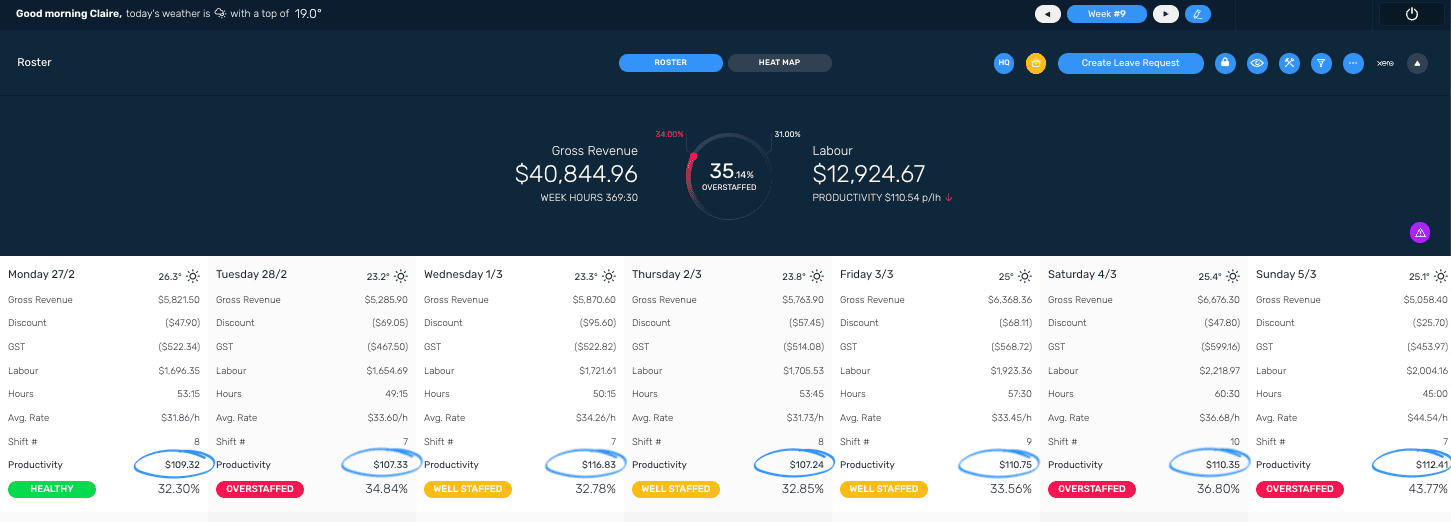

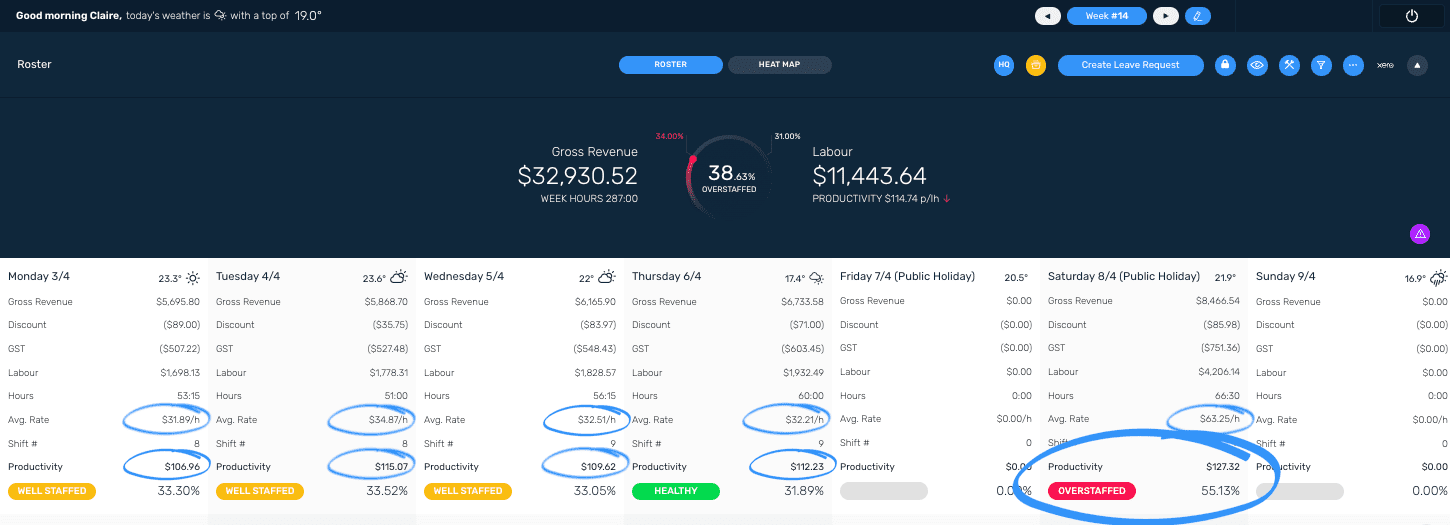

This site pays a manager, and also pays many team members above the industry award rate (see avg. rate data in image below). The max desired staffing percentage is 33.5%. In the image below you can see the site overspent their labour budget, in part due to training new team members on Tuesday. The red overstaffed feedback on the weekend shows the challenge that even standard weekend penalties present for teams to stay within a good staffing budget.

By looking at productivity (revenue generated per labour hour worked) circled in blue above, we can see that the weekend averages a similar productivity ($105-115 per labour hour) to the rest of the week, meaning the team is working just as hard. Therefore we understand the red feedback on Saturday and Sunday comes entirely from the penalty rates, and isn’t due to a lower team performance.

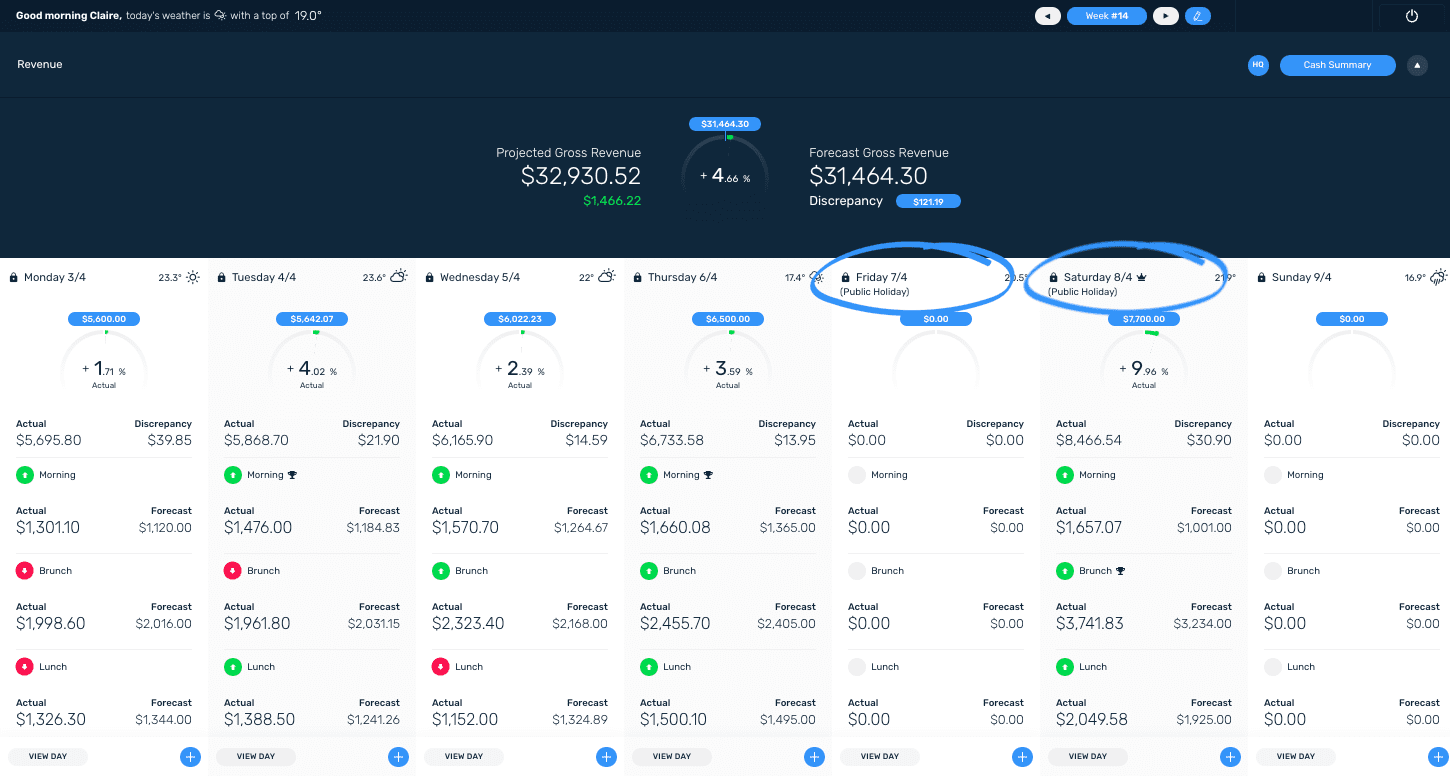

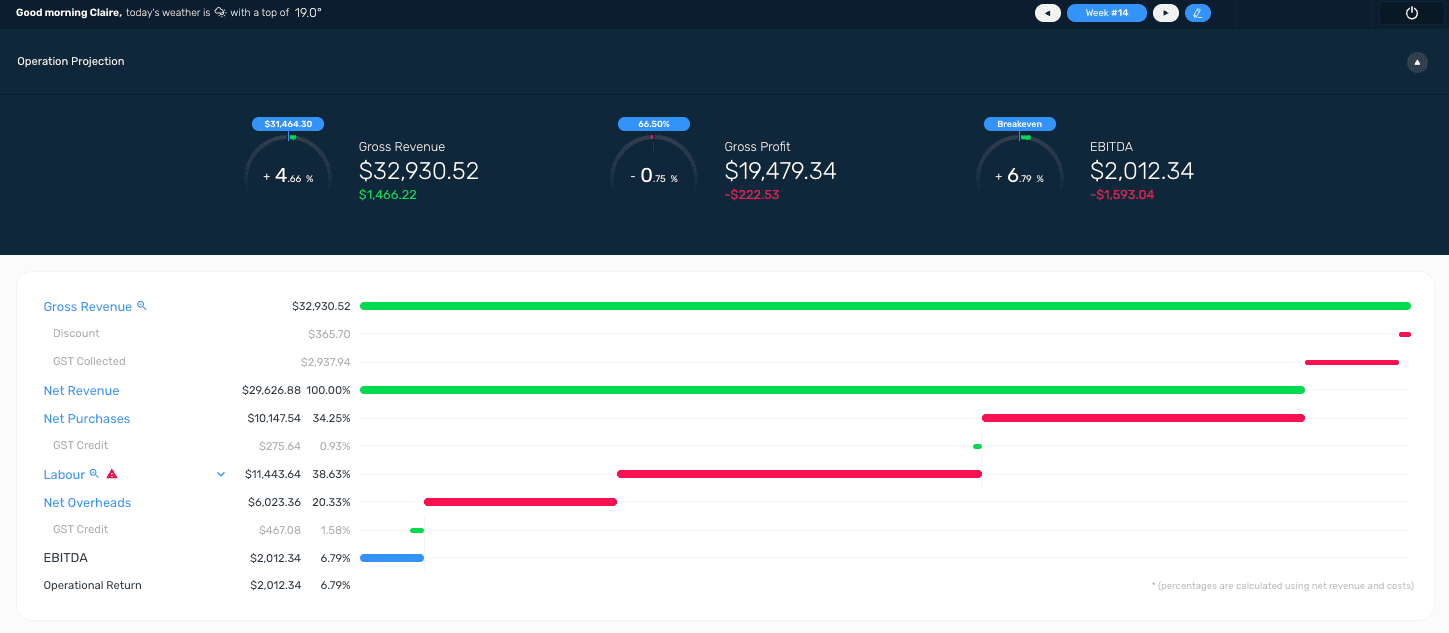

Now, let’s look at the same site on the week of Easter break, which included 2 days when the shopping center was closed (Fri, Sun) and one public holiday (Saturday), when the owner was able to open. Despite achieving very high revenue on Saturday, their weekly revenue dropped significantly compared to a typical week, down $7K+, or around 20% less than usual.

Their roster clearly demonstrates the challenge of public holidays. As seen in the average rate data below:

- the average employee rate nearly doubled

- the team worked extra hard, with a productivity of $127 per labour hour compared to the normal $105-115

- the site paid 55.13% of NET revenue directly to wages.

- across the week, this meant blowing the staffing budget to 38.63% – 5% above the normal target.

For their profit margin, this meant an achievement of less than half the usual percentage. They achieved 6.79% – $2,000 in real terms (40% of the typical achievement of $5,000).

So what does the data say about surcharges on public holidays?

It says your favourite places are opening on a public holiday because they love you, and they want to provide a service to their loyal customers. Not because they’re going to make any money. In fact, they’re going to make far less profit in a week with public holiday/s, whether they put a surcharge on your bill or not. That 15% could even be the difference between them losing money to open, or maybe breaking even.