Overheads made visible

The simple way to track and manage your ongoing expenses.

Overheads Guide

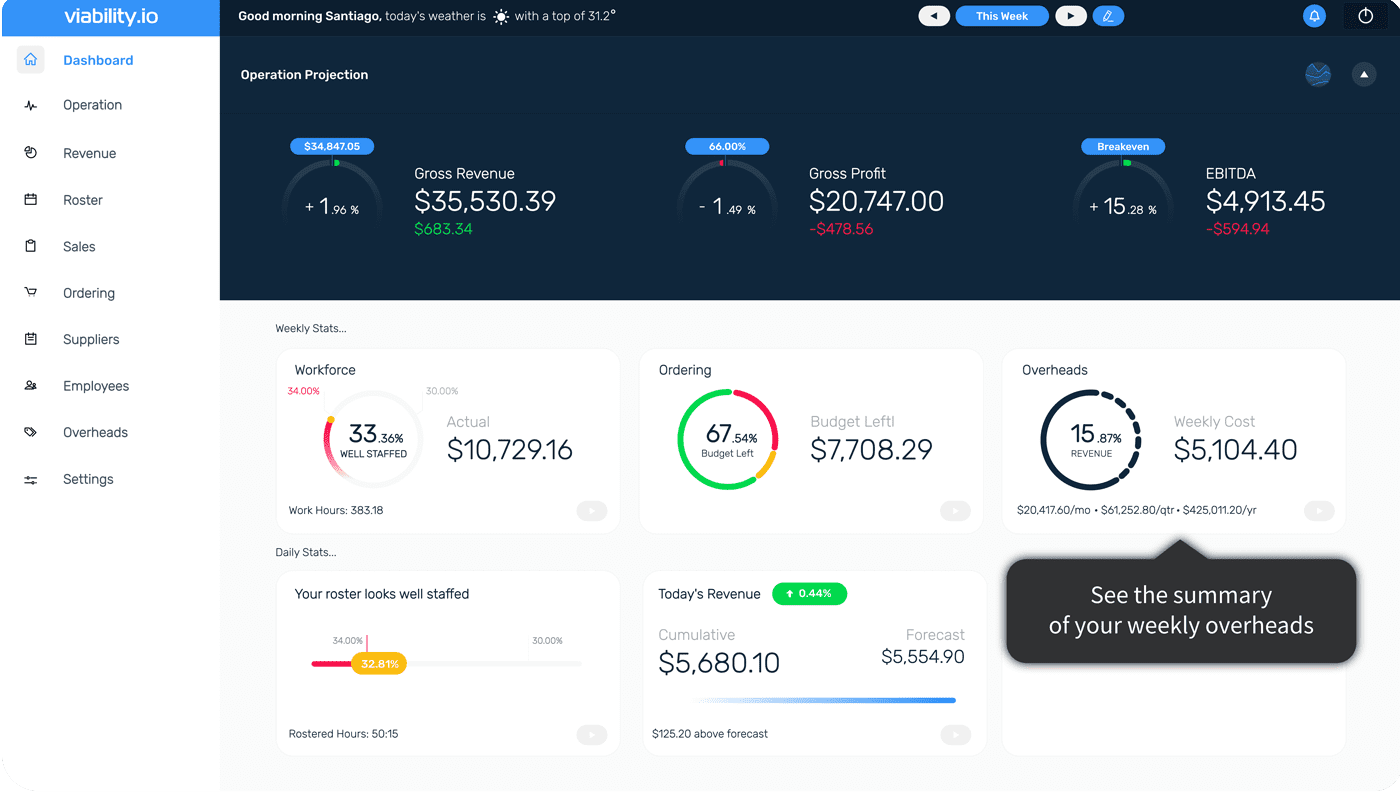

Understand your true financial position

Do you know how much running your business costs you each week?

Your bills are paid monthly, quarterly or completely at random, so it can be a bit of a nightmare to calculate ahead of time what your true weekly or monthly cost will be, accounting for all your bills, GST, interest and the other ‘surprises’. With Viability, see your paid, pending and upcoming costs instantly. Your overheads costs are distributed across the time they apply, to give you a real picture of your true financial position.

- Forget nasty surprises

- Whether we’re expecting them or not, bills can be a bit of a shock. One big quarterly bill can knock you over when the cost hasn’t been distributed evenly throughout the months, as it actually applies. Viability knows what’s coming … and takes that into account for every single one of your figures, meaning you always have a true picture of your position, and can forget the stress of surprises.

- Take control of your business

- If you’ve always left overheads to your bookkeeper, or if seeing your P&L at the end of the quarter or year comes as a surprise, it’s time to take control. Viability means the end of complicated overheads management. No spreadsheets, no paper. Just a simple, straightforward way to understand your overhead costs in minutes.

Overheads

The bills you commit to before you even open your doors to trade.

The cornerstone of profitability

Understanding your overheads is essential for success.

Overheads: the silent assassin of profit

Overheads are often the least understood cost in business, but they’re the most important to get correct from the beginning. Because once you’re operating, it’s hard to change your overheads costs; staffing and purchasing can be tweaked to improve profit, but your rent is set from the day you sign the contract.

To change your profit, change the way you think about profit

Instead of thinking of profit as dependent on revenue, consider it dependent on costs. It’s just another slice of your revenue pie. After all, without profit, there’s really no point in doing business. Just like rent and labour costs, profit needs to come out of your 100% revenue.

Feasibility & business success

Once you understand your overhead costs, you find your sustainable business model.

Unfortunately, some businesses are doomed to struggle before they even begin. Sometimes they’ve taken on a rental contract that represents a high percentage of their expected revenue. They need to increase revenue significantly to make money… and we know that’s no easy task.

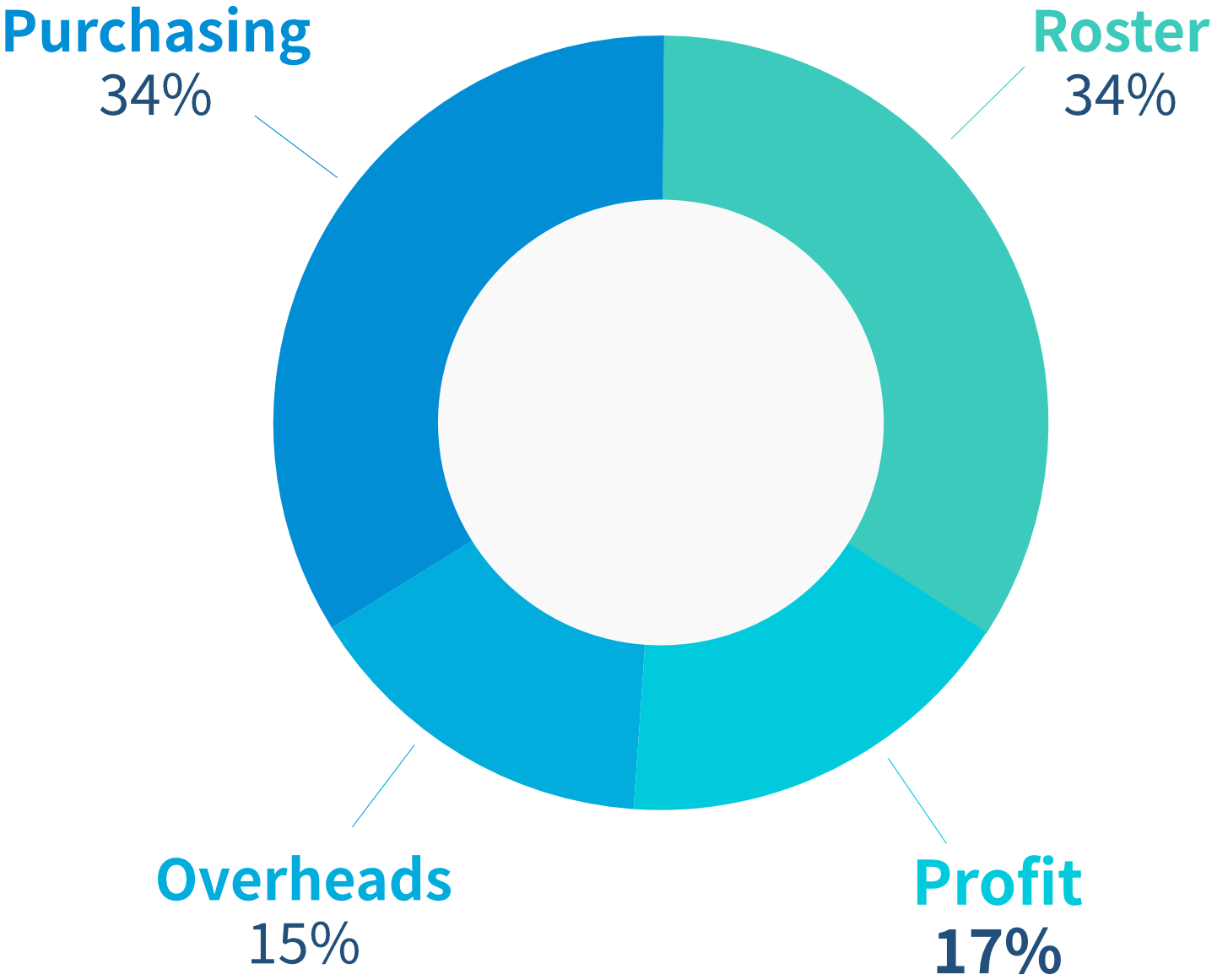

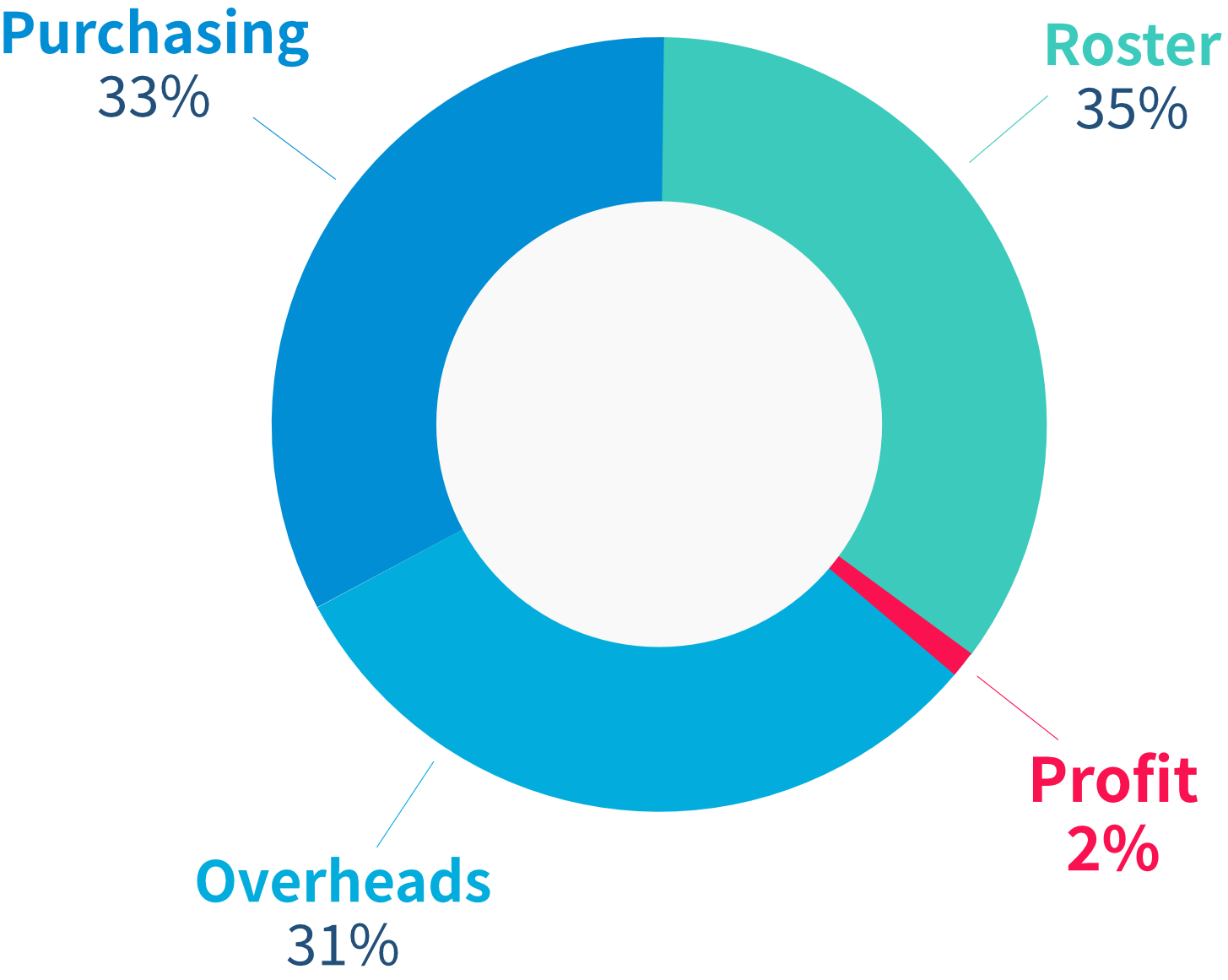

In the following pie charts, you’ll see what a difference your overheads percentage can make against some average benchmarks for labour and purchasing. As the overheads increase, the profit drops. The only way to keep a healthy profit with high overheads costs is to significantly reduce staff or orders, to far below standard industry benchmarks. And so often that just isn’t plausible.

Revenue: $20,000

Overheads: $3,000

Staff: $6,800

Purchasing: $6,800

Profit: $3,400

With the same revenue, staffing and ordering benchmarks, this site with 15% overheads is looking great.

If they start to cut a little from ordering and staff, their profit could exceed 20%.

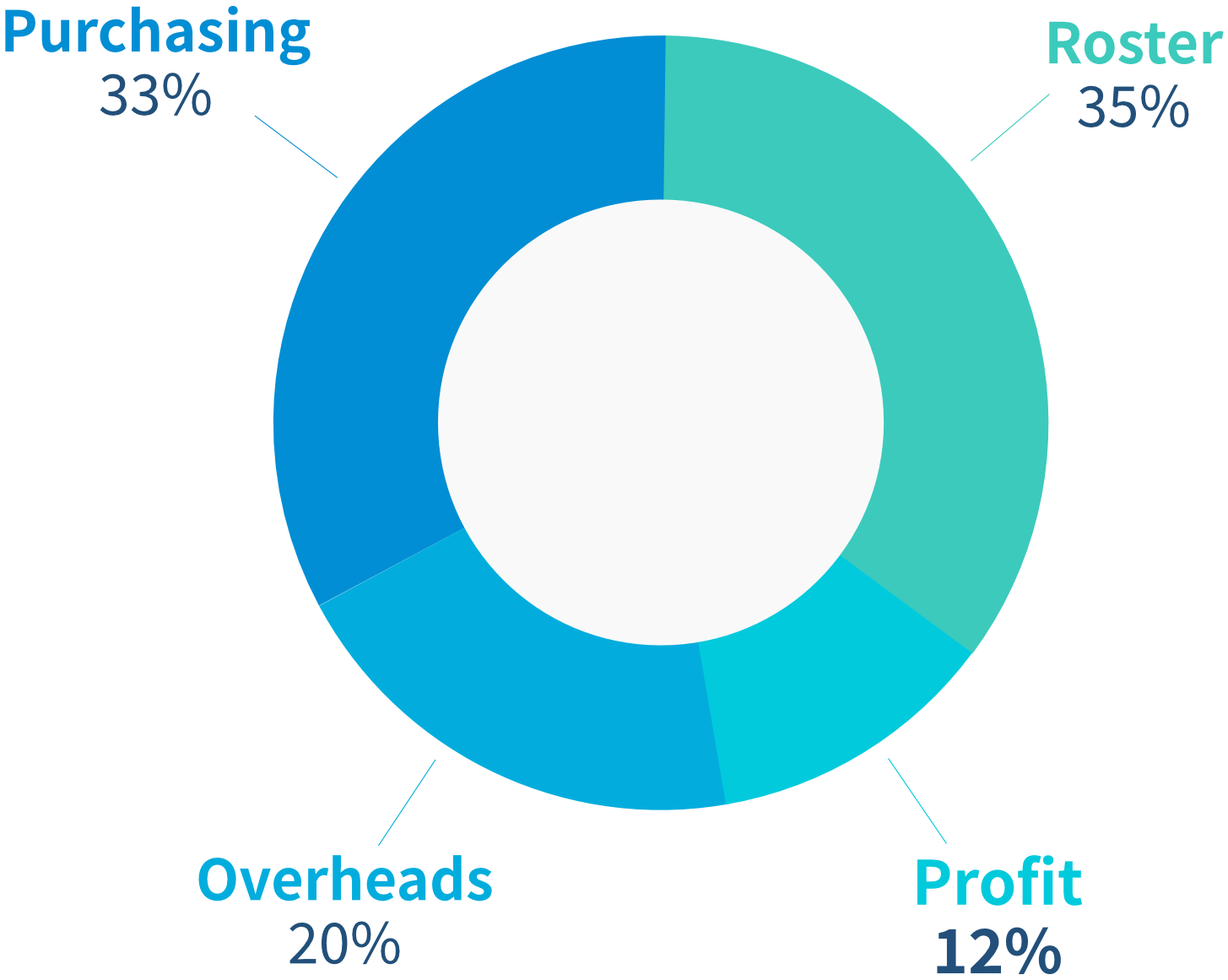

Revenue: $20,000

Overheads: $4,000

Staff: $7,000

Purchasing: $6,600

Profit: $2,400

With the same revenue, this site with 20% overheads is still making a sustainable profit of 12%.

By working a little on their roster and purchasing they could do even better, reaching 15 or 17%.

Revenue: $20,000

Overheads: $6,200

Staff: $7,000

Purchasing: $6,600

Profit: $200

Smarter Data

How does overhead data management work?

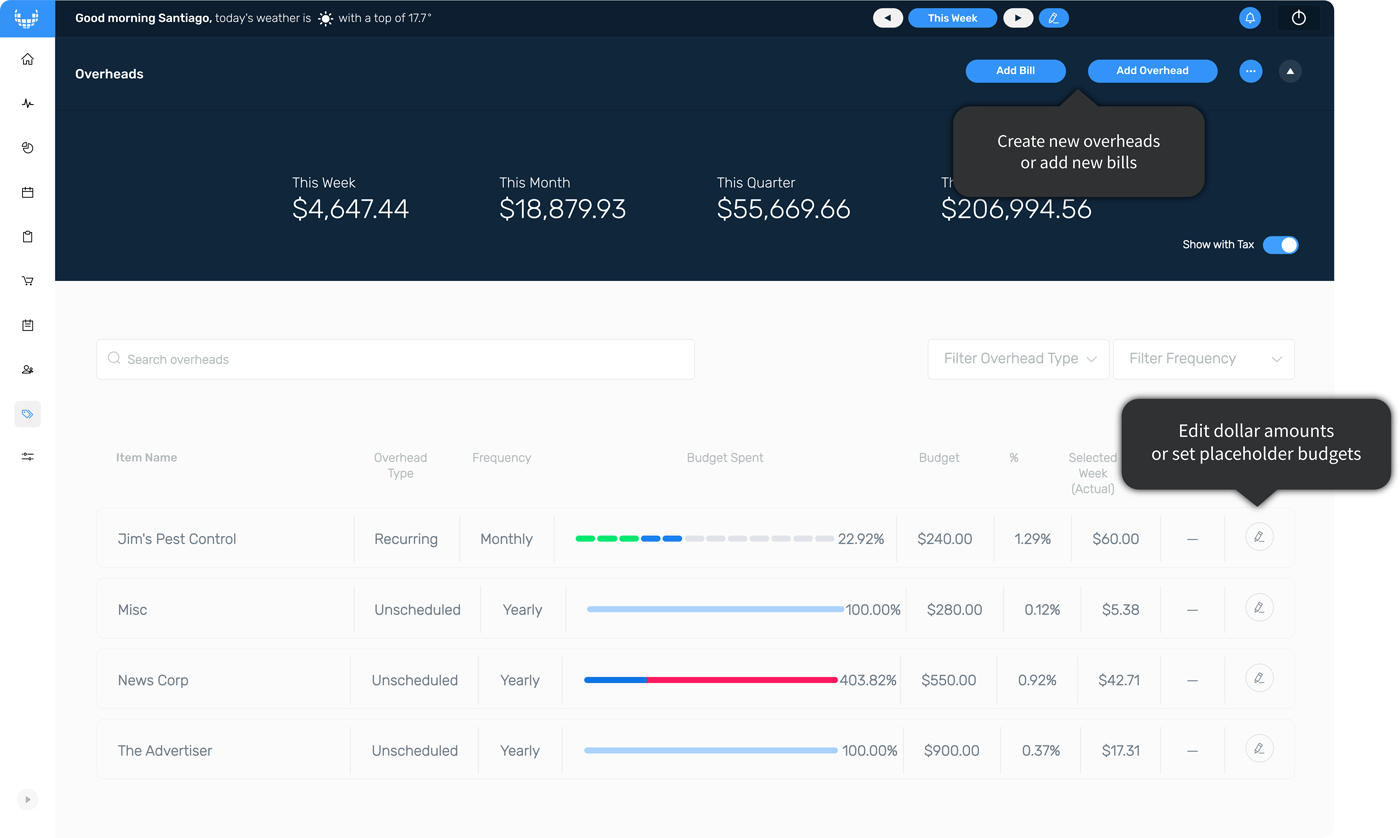

With overheads, like everything else in Viability, we predict approximately how much something will cost, create a budget, and record when the budgeted number turns into an actual cost.

Why not leave it to my bookkepper?

Actually, you can still leave it to your bookkeeper if you want. For them Viability will offer a quick, easy and accurate way to record your data and ensure you can see it without having to hassle them for information.

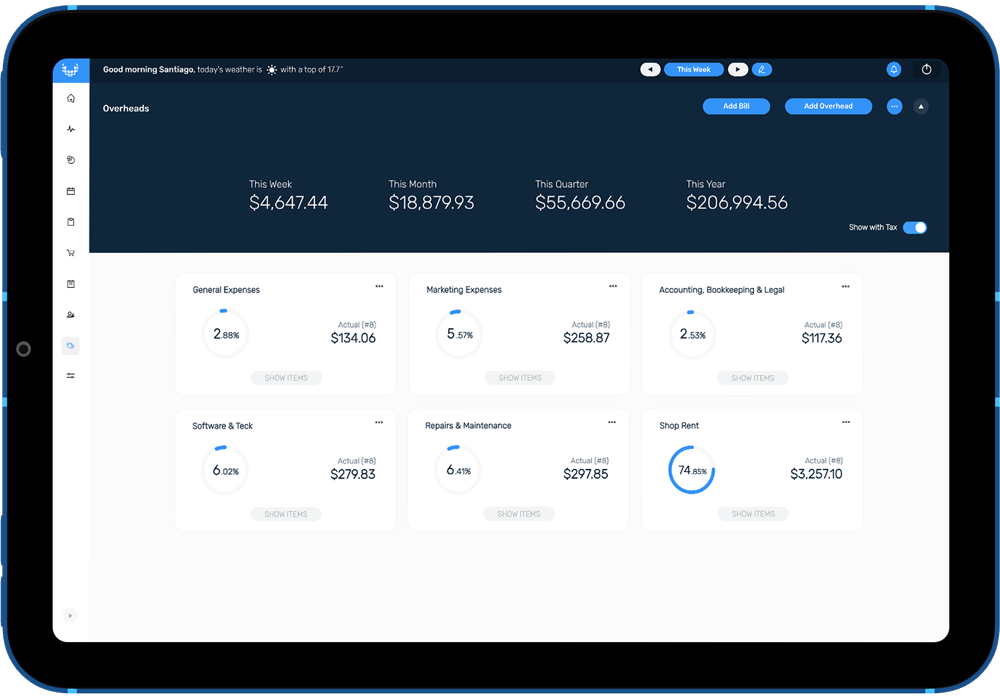

But more importantly, no matter who enters the data into Viability, you can view and manage your overheads, see what’s been paid and understand exactly how much you’re spending each week, month and quarter to keep your business running. Without having to ask, chase, question or somehow remember everything. It’s always there for instant visibility.

Even if you don’t actually do the bookkeeping yourself, you’ll see your costs against your revenue and can balance them with your percentage benchmarks for labour and purchasing. You can take control of your overheads to take control of your profit.

From budget to actual

- First, you create overhead budgets.

- Each different type of bill you receive is considered a different overhead cost, and has a budget against it.

- From budget to actual

- Next you receive the actual bills.

- Then you reconcile the bills against the budget you created for that overhead.

- By simplifying the process, we make it easy to understand how your overheads costs really look, meaning you know where you’re starting from.

How to manage overheads with Viability

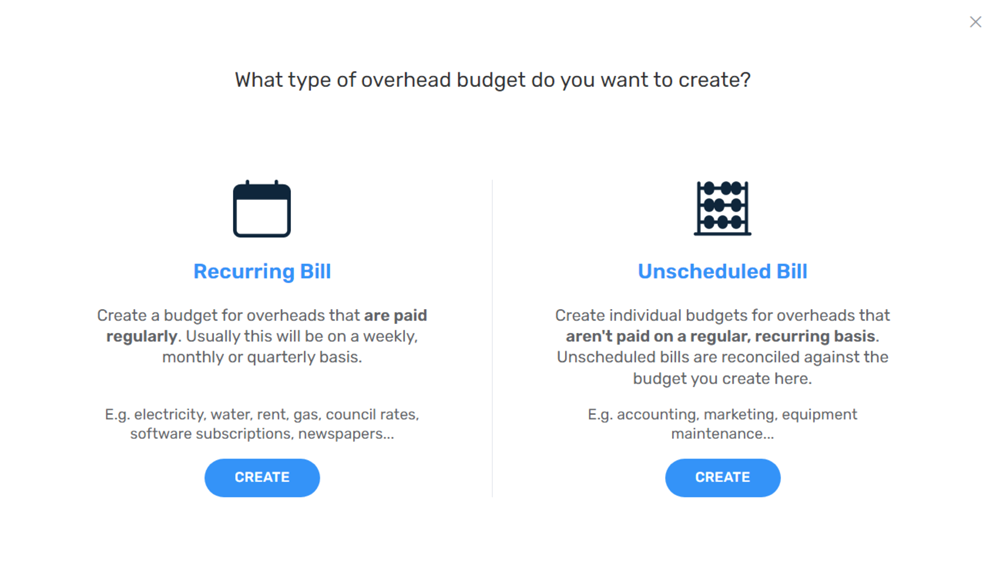

We split overheads into two categories to get the most accurate data.

Recurring bills

These are bills we know will come every week, month or quarter. We budget for the expected amount at the expected interval.

We expect to pay the same amount for rent each month, or a fairly consistent amount for electricity each quarter.

This means we can have a pretty accurate budget. As we enter the actual cost of the bills, Viability replaces the budgeted cost with the true cost in our real-time finances and the projected and forecast returns.

Unscheduled bills

Bills that we know are likely to arrive, but we’re not sure when or how much each bill will cost. Things like maintenance and marketing are usually these types of bills. For these, we choose an expected budget against a time period. We expect equipment maintenance to cost about $5,000 per year, but we don’t know exactly what will need repair, when, or how much each repair will cost individually.

Viability spreads our budget of $5,000 across the year, so each week’s forecast includes $96.15 in the overheads budget for maintenance. This means you have a realistic idea of the true cost of maintenance and your real financial position, and have already accounted for costs that may occur later in the year when considering your profitability.

Placeholder budget

If you don’t yet have a detailed understanding of every single overhead you’re likely to incur, you can set a Placeholder budget. This is an estimate for whatever portion of your overheads are ‘unknown’. This allows you to start getting forecasts and mapping your business even before you have everything set up.

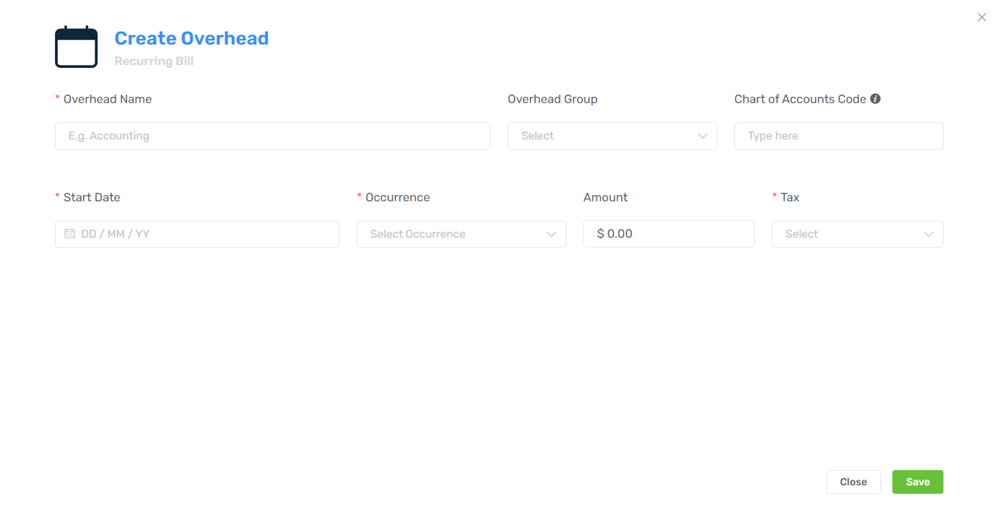

Creating an overheads budget

Use our pre-established options or simply create your own. You’re in control.

What it means - Term definitions

- Overhead name

- Enter a name that is simple and will make sense to you as well as your bookkeeper and anyone else who deals with overheads.

- Chart of accounts code

- These are what accountants use to identify different types of payments. These are usually short numbers, unique to different areas of your business. Your accountant should be able to help you identify your Chart of Accounts codes.

- Amount

- This is the budgeted value for the overhead—the average amount each bill will cost when you receive it. Remember the amount is per period (for the occurrence you set), not per year.

- Overhead group

- Choose the group that is most appropriate or create a new overhead group for your costs.

- Start date

- The start date is the date from which you will start incurring this cost. Eg. if your first electricity bill will arrive in February for the period 1 January to 2 February, your overhead start date is 1 January.

- Occurrence

- How often will you receive individual bills for this overhead? Choose if it is a weekly, monthly, quarterly or yearly occurrence. The cost of your bills will be automatically distributed evenly throughout the week, month, quarter or year.

- Tax behaviour

- When creating an overhead, you must select how you’d like Viability to treat GST for that overhead. When you receive a bill, does the total on the bill already include GST?

- If GST is included in the total bill amount, select Tax included. OR When you receive a bill, does the total on the bill exclude GST?

- If GST is not included in the total bill amount and you will be entering the without tax amount into Viability, select Tax Excluded. Viability will automatically calculate the GST component for you when you enter the GST exclusive bill total.

FAQs

Your overheads data is used throughout Viability. Altering the occurrence can throw out your visibility. If you want a different occurrence, "zero" the overhead by making the budgeted cost $00.00 and assign it to a Discontinued or Retired group. Then follow the steps to create a new overhead with the correct occurence.

Usually packaging costs are considered part of your purchasing budget. Like food and beverage costs, packaging can be renegotiated with your suppliers. Cost can change based on what's on your menu.

You can't delete overheads because you'll lose the historical data. Instead, edit the overhead by clicking the pencil on the right. Simply zero the overhead by making the budget (Amount) $0. Move the zeroed overhead to the Discontinued or Retired group to keep your overheads management tidy.

Tax included: the total amount on the bill you receive already includes GST.

Tax excluded: the total amount on the bill you receive doesn't include GST yet.

Tax free: You don't pay tax on this overhead. Usually this will only be for things like interest on loans.

Click the three dots in the top corner to set or change your placeholder.

The placeholder is an estimate that can represent all or a part of your overheads budget, before you've entered all the true overheads. When you have an actual value to replace some of the placeholder, create a new overhead and slide the toggle to subtract it from the placeholder.

The placeholder will reduce when you slide the 'Placeholder' toggle.

Didn't find an what you are looking for?

If your question is not in the FAQs list, feel free to reach out for additional support and guidance.